PERSONAL BROOD

TRAINERS

-24/7 supplement Center

-24/7 Personal trainer

-24/7 towel concierge

-24/7 Fitness Library

TESTIBRONIALS

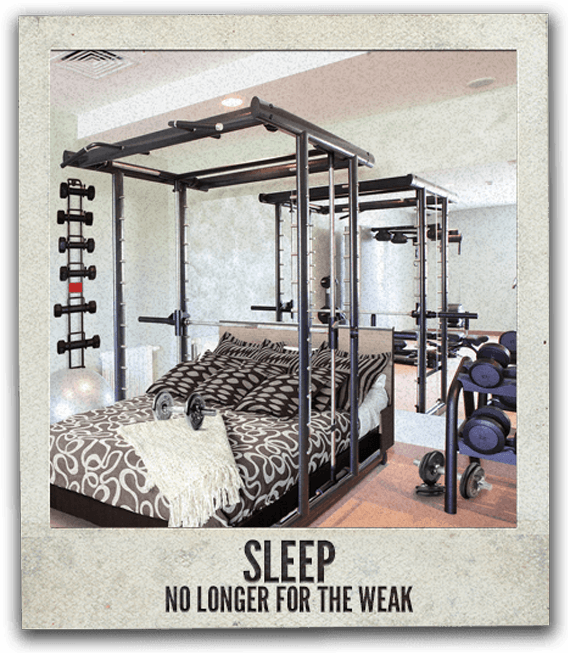

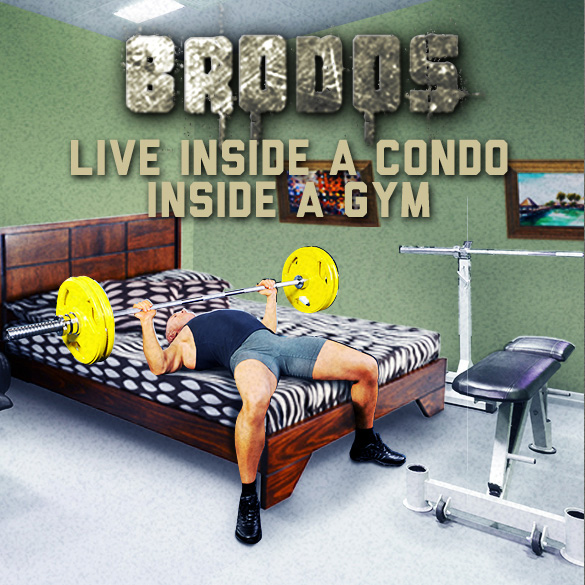

My favorite places to

hang were the gym

and my house. My new

favorite place to hang? Brodos.

— KERRY L, VENICE, CA

WHY WALK TO THE GYM

WHEN YOU CAN LIVETHERE?